Audience Analytics: a long, golden runway on the shoulders of SMEs

- Indraneel Kasmalkar

- Feb 18, 2024

- 5 min read

Updated: Feb 22, 2024

Disclaimer: This article discusses stocks for informational purposes. Do not make financial decisions without consulting your fiduciary.

Introduction

When we look for businesses that can serve as promising compounding machines, we are looking for two key characteristics. First, the business model must have a crystal-clear blueprint for scaling up. Second, there must be a strong, durable moat that prevents others from cloning this lucrative business.

Audience Analytics (SGX:1AZ) fits the bill. This is a microcap business with a market cap of SGD 50 million as of 2023. It primarily hosts business awards for Small & Medium Enterprises (SME) – think of the highly reputed SME100 or HR Asia Awards. Audience Analytics organizes the awards, collects data from participating SMEs, identifies best-performing companies, and organizes the award ceremonies. It has cultivated these prestigious awards over a period of 10+ years, making them highly prized icons of branding and reputation in the eyes of SME executives.

Audience Analytics has a three-pronged strategy for scaling up its business model:

attract more SME participants to existing awards,

host existing awards in new markets,

and create new awards altogether.

With this long runway for growth, and a current price-to-earnings (PE) ratio of 9, Audience Analytics presents a fantastic investment opportunity.

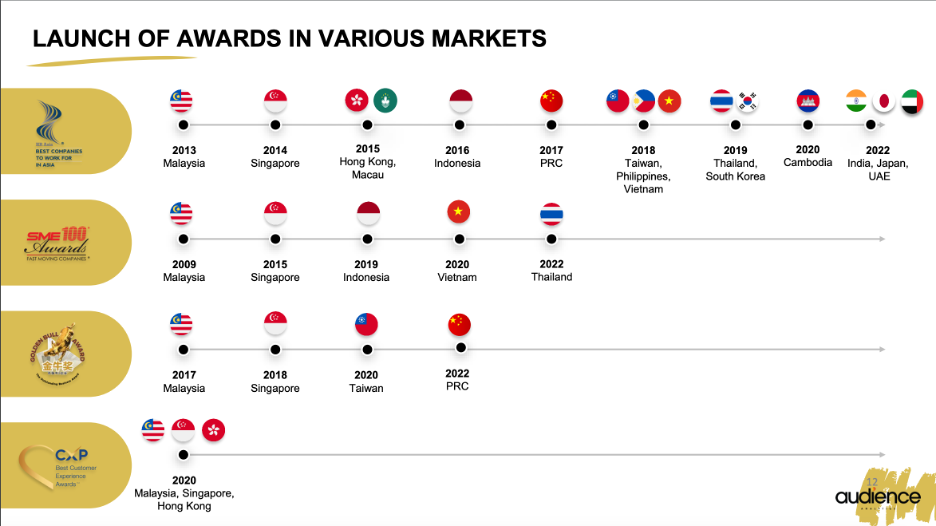

Audience Analytics Annual Presentation 2022. Timeline of Launch of Awards.

The business characteristics

Audience Analytics started off as the Malaysia Career and Training Fair in 2002. Sensing limited growth opportunities in the exhibition segment, it then expanded into the print business with the launch of the SME100 magazine in 2005. In 2009, it leveraged its range of magazines into a number of business awards. It has been hosting the awards ever since, with gradual growth into new Asian markets. Audience Analytics went public in 2021 with a revenue of SGD 7.2 million. It has maintained excellent synergy between its three segments: the business awards, the magazine business and the conference and exhibition business. However, the business awards segment is the outsized revenue generator (~95% of revenue).

The moat of Audience Analytics comes from the branding of the underlying established awards and magazines. It is just not possible for another company to brew up a new award in a short amount of time. While there are other long-standing awards, such as the Singapore Prestige Brand Award or the Entrepreneur of the Year Award, they are often region-specific awards hosted by region-specific entities. Audience Analytics has much more flexibility than the regional players: it can buy the hosting rights for awards as in the case of the Golden Bull Award, it can partner with regional players to co-host awards, and it can also clone its awards in multiple regions.

An interview of Datuk William Ng, founder, CEO and majority shareholder of Audience Analytics. School of Life Malaysia (2020).

The founder, Chief Executive Officer (CEO) and majority shareholder, Datuk William Ng, demonstrates a seasoned understanding of SMEs across Asia, as seen in his interviews (above). Through his work at Audience Analytics, he has cultivated deep connections with SMEs and governments. For example, the Deputy Finance Minister of Malaysia spoke and presented the awards at the 2023 SME100 Awards. These kinds of connections and networks allow the CEO to increase the value and impact of the awards.

The success of Audience Analytics is seen clearly in its stellar financials. It has maintained a net profit margin of 25+% and a return on equity of 40+% since 2018. As of 2023, it has a fortress balance sheet with a whopping equity of SGD 15 million (total assets SGD 19 million), and a minuscule, shrinking debt of SGD 0.1 million. Thanks to its asset-light business model, the company is awash in free cash flows, which are themselves growing at a compounded annual rate of 50% since 2018. As a bonus, the company aims for a 50% dividend payout, which is fantastic news for shareholders!

Huge upside: data analytics!

While the existing business segments offer good growth on their own, there is huge upside potential from its fourth segment: the analytics of SME data. Audience Analytics has reportedly collected financial data on over 500,000 SMEs in the Asia region. Imagine the use cases for this data: companies could find new corporate customers and tailor better products, investors could identify new investment opportunities, and banks and insurance companies could better assess credit risk!

One of the goals of its Initial Public Offering (IPO) in 2021 was to raise funds to build a robust data analytics team. Admittedly, the company has not made much progress on it except for a 2021 partnership with the Dow Jones Factiva platform, and a digital tool that serves as a survey of employee satisfaction. However, this could change in the next few years, unlocking immense value for shareholders.

Potential risks

Given the strong branding of the awards and the number of years it has taken to develop the branding, I do not consider competitors as a big risk. There is, however, business cycle risk: SMEs may choose to deprioritize business awards and branding during downturns, thus causing a major drop in the revenue of Audience Analytics. There was certainly a drop in revenue during the COVID-19 lockdowns of 2020. My only counterpoint would be that Audience Analytics has survived for the past 20 years in one form or another. In particular, it has survived the 2008 Financial Crisis and the 2020 lockdowns. While future downturns may serve as temporary speed bumps, they are unlikely to detract from the long term growth potential of the company.

Ownership structure

Insiders own about 85% of the stock through a private entity, Bain Equity Sdn. Bhd, which is split 60-40 between CEO Datuk William Ng and Executive Director Dato’ Ryan Ooi. This owner structure highlights two points: first, the publicly available shares of the company are scarce to begin with. Second, the company operators are completely aligned with shareholders. These points strengthen the case for investment in Audience Analytics.

Valuation

Audience Analytics had an IPO price of SGD 0.30 in 2021 which fell to SGD 0.18 in 2022 and rose back to 0.30 in 2023. It currently stands at a PE ratio of 9, but it is hard to tell how high the PE ratio might go because of its unique business model. So let us assume that the PE hits the Singapore listed companies average PE ratio of 20 [1]. Next, since Audience Analytics has demonstrated a median annual earnings growth rate of 34%, let us assume a conservative growth rate of 28%. Therefore, the earnings per share of SGD 0.03 in 2023 would rise to SGD 0.35 in 2033, leading to a price of SGD 7.0 per share. And this valuation does not even consider the upside potential of the SME data analytics segment!

SME100 Awards Vietnam 2020.

Final thoughts

Audience Analytics has cultivated valuable assets in the form of business award brands such as SME100, Golden Bull Award, and more. Based on these brands, the company has built a unique business model that is profitable, scalable, and provides real value to SMEs in the form of branding and recognition. The company has stood the test of time over the past two decades and has a long runway of growth ahead. Plus, it has upside potential from the analytics of proprietary financial data of SMEs. What’s not to like?

REFERENCES

[1] Simply Wall Street. Singaporean (SGX) Market Analysis & Valuation.

All financial information for Audience Analytics (SGX:1AZ) was derived from the SGX investor portal.

Comments